No Asset Procedures

A No Asset Procedure (NAP) is the best insolvency option if you owe less than $50,000, have no assets and have no extra money to make repayments towards your debt.

On this page

Meet Felicity and George

Watch as Felicity and George talk about their unique financial challenges and explore the options available to each of them.

Watch: I owe less than $50,000 that I can’t manage

Video transcript: I owe less than $50,000 that I can’t manage

[Audio: Upbeat music plays.]

[Visual: Background is 3 geometric triangular shapes in teal, turquoise and coral colours. New Zealand Insolvency and Trustee Service branding in white in the middle of the page.]

[Visual: Title of video appears reading 'I owe less than $50,000 that I can’t manage'.]

[Visual: Screen switches to the presenter standing in an office setting. In the bottom right corner of the frame, a New Zealand sign language interpreter translates throughout the video.]

[Visual: Turquoise box appears in the lower left hand corner, with white writing which reads ‘For debt under $50,000 here are the insolvency options to get you back on track’.]

[Audio: Presenter speaks.]

Presenter: If you’ve got to a point where you can’t manage your debt repayments, it could be time to look into an insolvency option.

If you owe more than $50,000 in unsecured debt, bankruptcy is your only option.

[Visual: Turquoise box moves off screen to the left.]

Presenter: It’s still an option if you owe less than that but there are also a few other ways to manage your debt depending on your circumstances.

[Visual: Turquoise box appears on the lower left-hand corner with white writing which reads ‘Debt Repayment Order’.]

Presenter: If you owe less than $50,000 in unsecured debt, and you can afford to repay some of your debts, you can apply for a Debt Repayment Order, or DRO.

[Visual: Turquoise box moves off screen to the left.]

Presenter: If you’ve got less than $50,000 secured or unsecured debt, can’t afford repayments, and you don’t have anything of value that you could sell to help pay it off, you can apply for a No Asset Procedure, often called a NAP.

[Visual: Turquoise box appears on the lower left-hand corner with white writing which reads ‘No Asset Procedure’.]

[Visual: Turquoise box appears in the top right-hand corner with white wring reading ‘These options will have an impact on your credit rating for 5 years or more’.]

[Visual: Turquoise box in the lower left-hand corner moves off screen to the left.]

Presenter: Just remember, all of these options will have an impact on your credit rating for 5 years or more.

[Visual: Turquoise box in the top right-hand corner moves off screen to the right.]

[Visual: Screen switches to Felicity sitting on a sofa/couch.]

[Audio: Felicity speaks.]

Felicity: I don’t know what to do.

[Visual: Turquoise box appears on the lower left-hand corner with white writing which reads ‘Debt Repayment Order’. At the same time another turquoise box appears on the upper right-hand corner with white writing reading ‘Felicity has debt from:

- Buy Now, Pay Later

- Credit Cards

- Personal loans’]

Felicity: I’ve got 3 kids and a full-time job, but I only earn minimum wage, so things are really tight.

I’ve been using the credit card to buy a few extras here and there – like a new washing machine because my old one stopped working – and now paying it off is too much on top of the rent, bills and the personal loan I’ve got!

[Visual: Turquoise boxes both move from the screen. The lower one moves off to the left and the upper one to the right.]

Felicity: I can make some repayments – I just need some help and a bit more time to do it so I can still afford to look after the kids.

[Visual: Screen switches to presenter.]

[Audio: Presenter speaks.]

Presenter: Hi Felicity. Thanks for your honesty. We know it’s not an easy topic to talk about. The first step would be to reach out to a budget advisor or financial mentor to get some advice.

[Visual: Turquoise box appears in the upper right-hand corner. White writing reads ‘DEBT REPAYMENT ORDER’.]

Presenter: Your best option might be applying for a Debt Repayment Order, DRO, if your debt isn’t secured with an item that can be repossessed.

[Visual: Further white writing appears in the turquoise box in the upper right of the screen reading ‘DRO Supervisor’.]

Presenter: If you go down this path, you’ll sign up with a DRO Supervisor who will help you work out how much of your debt you can afford to pay each week. Your DRO Supervisor will work with you, the Official Assignee and your creditors to arrange the details and your payments.

[Visual: Further white writing appears in the turquoise box in the upper right of the screen reading ‘Debts combined’.]

Presenter: When the DRO is finalised, your debts would be combined, and you’d make regular repayments towards them. Every 6 months your creditors will receive payments towards the debt.

[Visual: Further white writing appears in the turquoise box in the upper right of the screen reading ‘Usually lasts for 3 years’.]

Presenter: A DRO usually lasts for about 3 years. You won’t be chased for payments by the people you owe and there won’t be any additional interest or penalties while you’re in the DRO. When your DRO is complete, any unpaid debts included in the DRO are wiped and you don’t have to worry about them anymore.

[Visual: Turquoise box moves off screen to the upper right.]

[Visual: Screen switches to George who is sitting on a sofa/couch.]

[Visual: Turquoise box appears on the lower left-hand corner with white writing which reads ‘Debt Repayment Order’. At the same time another turquoise box appears on the upper right-hand corner with white writing reading ‘George has debt from:

- Car finance

- Utility Bills’]

[Audio: George speaks.]

George: I was doing OK but I don’t earn much and the other day I had to pay for my car to be fixed.

I’m still trying to pay the loan on the car so now I’m behind on all my bills – my rent, my power, even my mobile.

[Visual: Turquoise boxes both move from the screen. The lower one moves off to the left and the upper one to the right.]

George: It’s the first time this has happened to me – I’ve always paid off my debts but right now I don’t have enough money coming in or anything valuable enough to sell to help pay it off.

[Visual: Screen switches to presenter.]

[Audio: Presenter speaks.]

Presenter: Thanks George. Looking for help is a great first step so you’re doing the right thing!

Budget advisors and financial mentors are a good place to start for anyone in your position. They’ll take a look at your budget and help you work out a solution.

[Visual: Turquoise box appears in the upper right hand corner. White writing reads ‘No Asset Procedure.

- Unsecured or secured debt

- Lasts for 12 months

- Enter NAP once’]

Presenter: It might be that a ‘No Asset Procedure’ is the best option for you.

[Visual: Further white writing appears in the turquoise box in the upper right of the screen reading ‘Unsecured or secured debt’.]

Presenter: You can apply for one with unsecured or secured debt.

A NAP doesn’t have as many restrictions as bankruptcy, but it will still have an impact on your credit rating which could affect your access to banking and other services.

[Visual: Further white writing appears in the turquoise box in the upper right of the screen reading ‘Lasts for 12 months’.]

Presenter: With a NAP, debts are wiped after 12 months, but you can only enter into a NAP once.

[Visual: Further white writing appears in the turquoise box in the upper right of the screen reading ‘Enter NAP once’.]

Presenter: So, if you’ve already completed one and can’t afford to make repayments, then bankruptcy is your only option.

[Visual: Turquoise box moves off screen to the upper right.]

Presenter: For more information or to apply for a DRO or NAP, go to insolvency.govt.nz(external link).

[Visual: Turquoise box appears in the lower left-hand corner of the screen. White writing reads ‘insolvency.govt.nz’.]

Presenter: Entering a formal insolvency procedure has consequences that could be significant for you, so it’s worth seeking independent advice.

[Visual: Turquoise box moves from the screen to the left.]

[Visual: Turquoise box in the top right-hand corner moves off screen to the right ‘MoneyTalks 0800 435 123’.]

Presenter: MoneyTalks is a free helpline offering budgeting advice to individuals, family and whānau. They can put you in touch with financial mentors who can help you understand your financial situation, organise your debt and plan for the future. Call 0800 345 123.

[Audio: Upbeat music.]

[Visual: Teal and white New Zealand Insolvency and Trustee Service branding and Digital Boost Branding show in top corners of the screen.]

[Visual: Appearing slowly white writing reads ‘Want to know more? Insolvency.govt.nz’.]

[Visual: White writing fading to plain teal background.]

[Visual: Teal background with the Ministry of Business, Innovation and Employment and New Zealand Government brandings in white.]

[End of video]

What it is

A No Asset Procedure (NAP) is a way to clear your debts if you have no way of paying them. It doesn’t have as many restrictions as bankruptcy, but it will have an impact on your credit rating and possibly your employment prospects.

A NAP usually lasts for one year. When you enter the NAP your debts are cleared. Your creditors (the people or organisations you owe money to) don’t get paid anything.

You can only enter into a NAP once — if you've already completed a NAP, bankruptcy is your only other insolvency option.

To enter a NAP you must owe between $1,000 and $50,000 in total. This can include secured debts like a couch you have on hire purchase, but it doesn’t include student loans, court fines or reparations.

You must have no way to pay any of your debt, and nothing that you can sell to help make payments, including money in a bank or other fund. Note however that KiwiSaver funds are protected in insolvency however once you are eligible to withdraw them, they can be included.

You can’t apply for a NAP if you have been in one before or have been bankrupt before, but you can apply if you have been in a Debt Repayment Order (DRO).

You can't enter a NAP if:

- you have hidden assets, e.g. if you transferred assets from your name to someone else.

- a creditor intending to make you bankrupt would get a better result if you were made bankrupt.

If you are living overseas you can still enter a NAP. Creditors that are not based in NZ will be sent a report if they are listed in your bankruptcy, but they can continue to chase you for any money you owe them.

The public register can be searched from overseas. Several credit reporting companies operate in more than one country so your credit rating outside of NZ may be affected.

How it works

You must:

- help the Official Assignee and provide all records and information you’re asked for.

- tell the Official Assignee if you change your:

- name, e.g. if you get married

- address

- employment

- terms of employment

- income and/or expenditure.

- file tax returns as normal.

You must not:

- incur $100 credit or more without disclosing your insolvency status between applying for NAP and being accepted into NAP.

- take on any new debt over $1,000 without making the new creditor aware that you are currently in a NAP. You should let them know in writing to avoid any misunderstandings.

- commit any offence under the Insolvency Act 2006, e.g. gambling.

How your creditors are notified

When you enter a NAP, the Official Assignee sends out a report to all the people you owe money. They can log onto our website to get updates after the first report is sent.

Once you're admitted to a NAP, creditors can't continue to chase you for any debt included in your NAP.

On discharge from your NAP, you are released from most of the debts included in your NAP and you don't have to pay any more of the outstanding amount owed to the creditors that were included in the NAP.

Included debt

Your NAP debts include all debts that you owe at the date of your application unless specifically excluded below.

- contingent debts — These debts will only be included in your NAP if you are required to make payments on the debt at the date of your application. e.g. when you sign as guarantor for a friend’s finance agreement. You don’t have to pay any money now but you might have to repay the debt in the future if your friend doesn't pay. This will become a new debt to you at that future date that is still owed.

- joint debts — if you owe a debt jointly with another person, the creditor has the right to claim the full amount from either person. So while you are released from the debt, the other person is not.

- overseas debt — Any debts owed to a creditor that is based overseas are included in the New Zealand NAP. However, if you return to the country where the liability was incurred then the creditor has the ability to recover any debt that is owed in that country.

Excluded debt

Some debts are legally excluded from the NAP. You must continue to pay:

- court fines and reparation debt

- debt that you incurred after applying for NAP

- student loan debts

- debts incurred fraudulently

- child support or maintenance

- secured debt - if you wish to retain those items.

Secured debt

Secured debts are any debts where the creditor can repossess your property if you stop making payments. For example, if you stop making the arranged payments for a car you bought on finance, the creditor can repossess the car under the finance agreement. If you want to keep the item, you will need to keep making those payments.

If you no longer have the secured property, then the debt is no longer secured over your property and must be included. Any balance still owing after the property has been repossessed and sold is included in your NAP.

You can’t enter a NAP if you have 'realisable assets' – things that can be sold to help repay your debt.

While you're in the NAP, you can keep:

- tools needed for your work (up to a certain value)

- necessary household furniture and effects (up to a certain value)

- a motor vehicle worth up to $6,500

- money up to a maximum of $1,300.

Although a NAP can help to resolve your financial problems, it will have a wider impact on your everyday life.

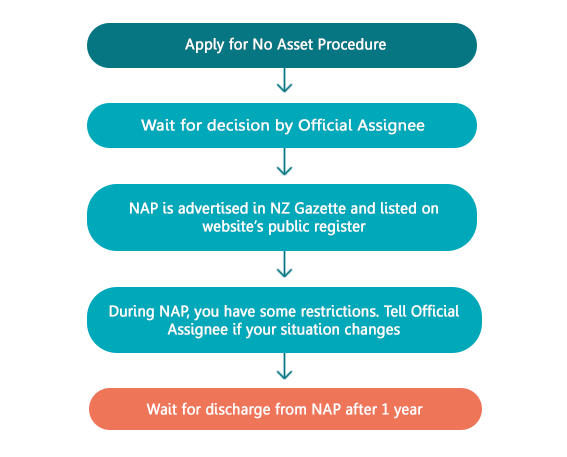

A flowchart that describes the life cycle of a No Asset Procedure, or NAP. Once you apply for a NAP, you need to wait for a decision by the Official Assignee, and your NAP will be advertised in the NZ Gazette and listed on the public register. Some restrictions will be in place while the NAP is in effect, and you must tell the Official Assignee if your situation changes. You will be discharged from the NAP after 1 year. Please note that your NAP steps might be different depending on your situation and conduct.

Note: This is a typical NAP - your NAP might be different depending on your situation and conduct.

How to apply

You can apply for a NAP online by following the steps at the link below.

After you've applied

- You'll hear from us within 10 working days. If we accept your application, your creditors will be told five (5) working days later.

- For privacy reasons your application won't be put on the public register unless it is accepted.

- Until your application is accepted, you'll need to keep dealing with your creditors and make payments as usual.

- If we need any extra information from you, we'll contact you. If you don’t provide the information quickly, your application may be rejected.

If your application is rejected by the Official Assignee, you can ask for the decision to be reviewed. You need to do this in writing within 15 working days — complete the application form below and send it to the Official Assignee by email or post.

Your application will be reviewed and you'll be notified within 15 working days of the Official Assignee’s decision.

You should get advice before making a new application, e.g. from the Budget Advisory Service.

- Your details will appear on our website.

- All the creditors included in the NAP will be sent a report.

- You should contact your secured creditors and arrange to either:

- keep making payments under your agreement with them, or

- arrange for the secured item to be returned or repossessed. You can then stop making any payments under the agreement and the unpaid amount will be included in the NAP.

You can check your estate details on our website to make sure we've been told about the creditor. (You should have been sent a code and instructions for setting up an account when your NAP started, if you didn’t already have a username and password.)

- Search the Insolvency Register for your own name.

- Click on your name (in blue and underlined) to see the basic details screen.

- Click the More Info button to see details of the claims and check whether the creditor is on the list.

If the creditor is not listed against your estate, give your estate officer their details so that they can be contacted and given a chance to file a claim.

If creditors that are included in the NAP keep chasing you for payment, give them your estate (insolvency) number and ask them to contact your estate officer. They can also search for your insolvency details on our public register.

Once you have entered NAP you need to cancel any direct debits, unless the type of debt isn’t included in your procedure e.g. court fines, Child Support. The Official Assignee cannot cancel the direct debit for you. You will need to contact your bank.

If you have an attachment order over your wages for a debt that is included in your NAP, your creditor should tell your employer to stop making the deductions once they receive the report from the Official Assignee. If this does not happen you need to take a copy of your NAP acceptance letter to the District Court that made the order and ask them to cancel the order.

After your NAP application is accepted

Once your creditors have been notified of your No Asset Procedure, some details of your file will be available on this website. You can log in to see your file and track the progress of your NAP.

- If you applied for your NAP online, you can use the same details to log in and look up your file.

- If you applied manually, you should have received an activation code or link with the written confirmation of your NAP acceptance. You can use this to activate your login on the website.

- Once you’ve logged in, scroll to top of page and click on Insolvency Register in the header of website.

- Enter your estate number or your name, and click Search.

- Click on your name when it appears in blue - this will show you basic information about your file. This information is also available to the general public.

- View extra information about your file by clicking on the More info tab at the top of the page.